How to check the tariffs of Optical Modules imported into the United States

Time: 2020-03-29

First of all, we have to find the list of customs codes for this kind of products imported into the U.S. Open the following website: Harmonized Tariff Schedule ;

This website is a sub-site on the official U.S. Customs website, which contains the U.S. Customs tariff rate for each tax code. At present, different U.S. companies will use different customs codes, the current use of the most mainstream there are 2, respectively: 8517.62.0090, 8517.18.0050. China and the United States of America, the first six bits of the Customs Code is the same, the last four according to the different countries have different refinements, so the direct download of the site's 85 chapter can be;

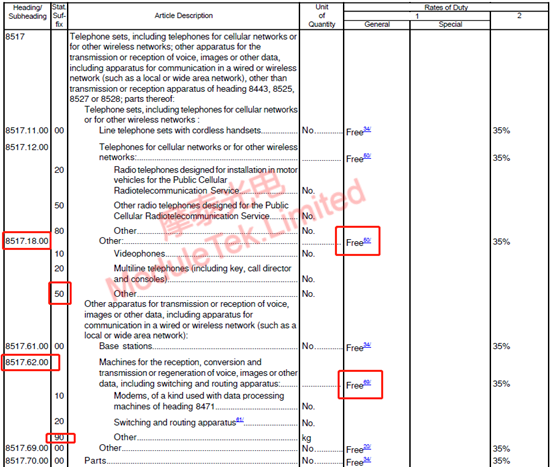

Open the file, search for 8517 directly within the file, as follows;

Figure 1 U.S. Customs Code show map

The first column in the figure is the first 8 bits of the customs code, belonging to a large category; the second column is the last two, belonging to the customs code of the suffix; the third column is the description of the customs code; the fourth column is the unit of measurement of the product; the fifth column illustrates the customs code of the import tariffs. But the tariff is divided into 1 and 2, of which 1 is divided into General and Special, and what do they represent?

The General in Tariff 1 is the tariff for imports from most of the world (Chinese products are subject to this tariff rate).

Special in Tariff 1 refers to the tariffs on imports from countries with which the U.S. has FTAs.

Tariff 2 applies to tariffs on imports from specialty countries with which the U.S. has no trade relations (Cuba and North Korea).

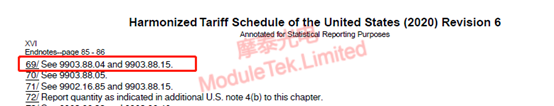

Here again we find that some tariff rates and product descriptions are followed by a small notation "34/" "69/", which indicates some special instructions. 8517.62.0090 to see, we can see in the footer of this page need to query the U.S. 301 document 9903.88.04, 9903.88.15.

Figure 2 Tariff Rate Mini-Labeling

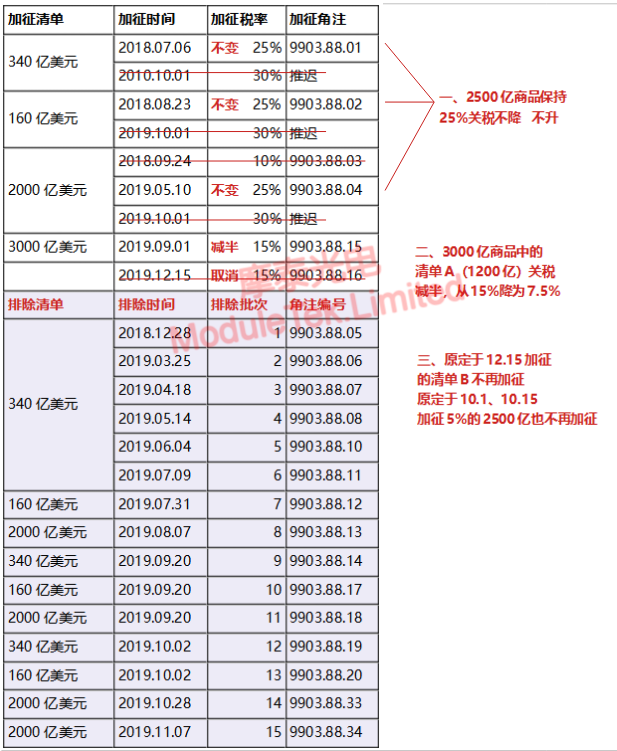

The following is the U.S. 301 document change record from 2018 to 2019:

Figure 3 U.S. Section 301 change records

Conclusion: In the current customs code of optical modules we use, 8517.62.0090 is within 9903.88.15, so it contains 7.5% extra tariff; while 8517.18.0050 has no extra tariff in this customs code due to the elimination of 9903.88.16.

Moduletek Limited will be happy to serve you.

If you have any questions about the above content, you can contact us by Email : web@moduletek.com

40G/100G Optical Transceivers

40G/100G Optical Transceivers 10G/25G Optical Transceivers

10G/25G Optical Transceivers 155M/622M/2.5G Optical Transceivers

155M/622M/2.5G Optical Transceivers 100M/1G Optical Transceivers

100M/1G Optical Transceivers FC 16G/32G Optical Transceivers

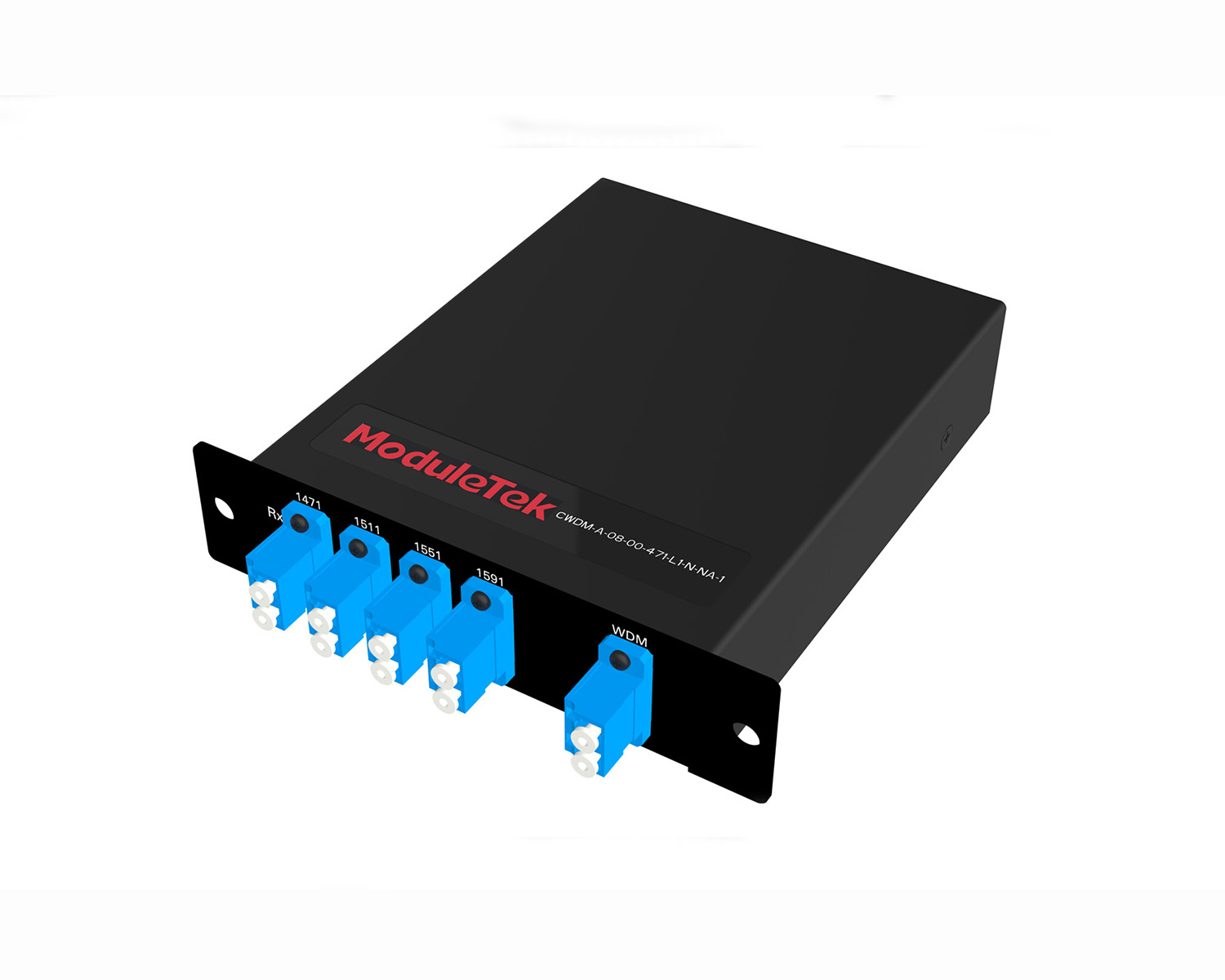

FC 16G/32G Optical Transceivers CWDM/DWDM Optical Transceivers

CWDM/DWDM Optical Transceivers 100M/1G/10G Coppers

100M/1G/10G Coppers Active Cable AOC

Active Cable AOC Direct Attach Cable DAC

Direct Attach Cable DAC Regular/MTP-MPO Fiber Patch Cords

Regular/MTP-MPO Fiber Patch Cords MT2011

MT2011 MT2010

MT2010 CodingBox

CodingBox