How to Confirm the Tariff on Optical Modules Shipped from China to the United States

Time: 2025-04-01

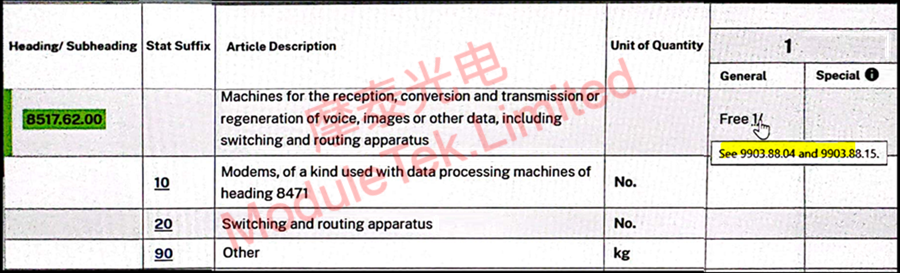

Currently, the U.S. import Harmonized Tariff Schedule (HTS) code for optical modules is 8517.62.00.90. On the U.S. HTS website https://hts.usitc.gov/ ,searching for "8517.62.00" shows the result "General Free1/", which indicates that attention should be paid to 9903.88.04 and 9903.88.15.

Figure 1 Search Results for 8517.62.00

The file [Chapter 99] can be downloaded from the top right corner of the aforementioned website, where details of 9903.88.04, 9903.88.15, and other tariff codes can be viewed.

Figure 2 Chapter 99

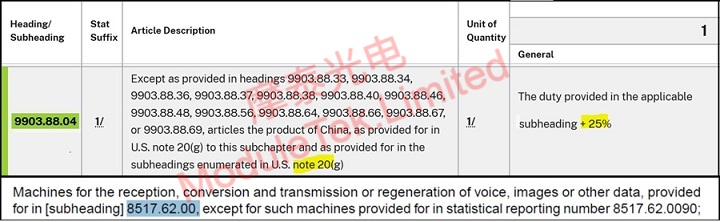

1. Details of 9903.88.04:No additional tariff is imposed on products with HTS code 8517.62.0090

Searching for "9903.88.04" in the [Chapter 99] file shows that a 25% additional tariff is required for this category of goods on top of the original tariff. Among them, U.S. Note 20(g) specifies that a 25% additional tariff is imposed on products with HTS code 8517.62.00 (except for 8517.62.0090). For specific file content, refer to the corresponding image below:

Figure 3 Details of 9903.88.04

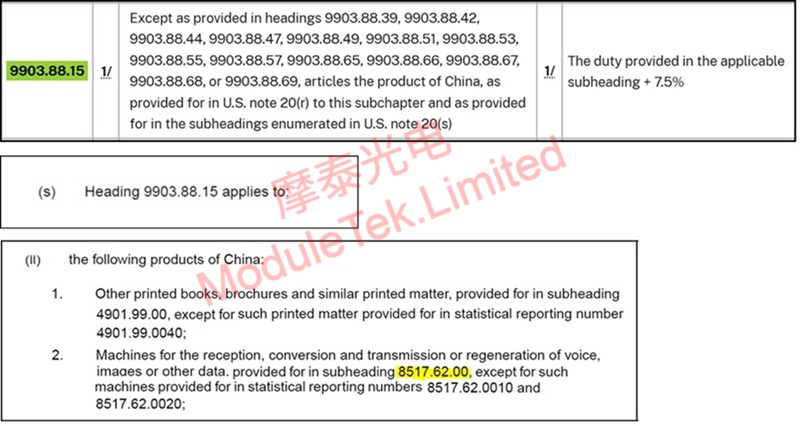

2. Details of 9903.88.15: A 7.5% additional tariff is imposed on products with HTS code 8517.62.0090

Searching for "9903.88.15" in the [Chapter 99] file mentions U.S. Note 20(r) and U.S. Note 20(s), which specify that a 7.5% additional tariff is imposed on products with HTS code 8517.62.00 (except for 8517.62.0010 and 8517.62.0020). For specific file content, refer to the corresponding image below:

Figure 4 Details of 9903.88.15

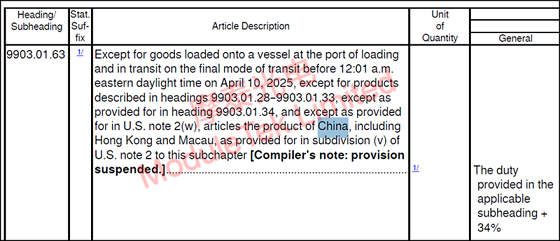

3. Details of Import Tariffs for Chinese Products

In addition, in the [Chapter 99] file, for products imported from China, attention should also be paid to 9903.01.63. Specifically, products classified under 9903.01.63 originally required a 34% additional tariff. However, on August 12, 2025, the White House official website announced that the 24% tariff would continue to be suspended for 90 days, while a 10% tariff would be retained. For products with HTS code 8517.62.00, importers can declare 9903.01.32 to be exempted from this tariff.

For reference, the content of 9903.01.63 in the [Chapter 99] file is as follows:

Figure 5 Details of 9903.01.63

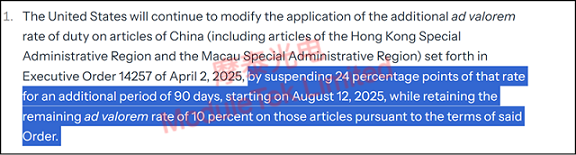

Key content of the announcement on the White House official website (August 12, 2025) is as follows:

Figure 6 Content of the White House Announcement

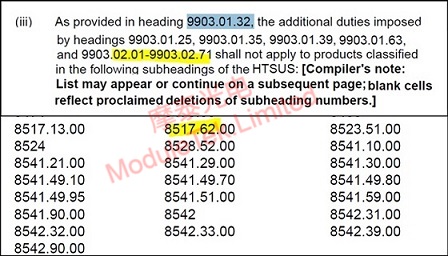

In the [Chapter 99] file, 9903.01.32 specifies that importers of goods with HTS code 8517.62.00 can declare 9903.01.32 to be exempted from the tariff under 9903.01.63. Key content is as follows:

Figure 7 Details of 9903.01.32

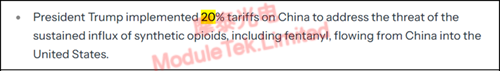

4. Fentanyl-Related Tariff: 20% Additional Tariff on All Chinese Products

Currently, the fentanyl-related tariff is found to apply to all goods exported from China to the United States, not just pharmaceuticals. No relevant exemption information has been found so far. The original article URL is for reference: :https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-closes-de-minimis-exemptions-to-combat-chinas-role-in-americas-synthetic-opioid-crisis/,Excerpts of key content from the original text are shown below:

Figure 8 Content of the Fentanyl-Related Tariff

Summary: As of August 16, 2025, for optical modules shipped from China to the United States (using U.S. import HTS code 8517.62.00.90), if importers declare 9903.01.32, the applicable tariffs are as follows:7.5% tariff under 9903.88.15; 20% fentanyl; related tariff Total tariff rate: 27.5%.

Note:

Policies are constantly changing, and tariffs involve numerous clauses/updates. The above content is for reference only; the actual tariff rate shall be subject to confirmation by the local customs.

ModuleTek Limited is at your service !

If you have any questions about the above content, please contact us via email: sales@moduletek.com

40G/100G Optical Transceivers

40G/100G Optical Transceivers 10G/25G Optical Transceivers

10G/25G Optical Transceivers 155M/622M/2.5G Optical Transceivers

155M/622M/2.5G Optical Transceivers 1G Optical Transceivers

1G Optical Transceivers FC 16G/32G Optical Transceivers

FC 16G/32G Optical Transceivers CWDM/DWDM Optical Transceivers

CWDM/DWDM Optical Transceivers SGMII Port Optical Transceivers

SGMII Port Optical Transceivers 100M/1G/10G Coppers

100M/1G/10G Coppers Active Cable AOC

Active Cable AOC Direct Attach Cable DAC

Direct Attach Cable DAC Regular/MTP-MPO Fiber Patch Cords

Regular/MTP-MPO Fiber Patch Cords MT2011

MT2011 MT2010

MT2010 CodingBox

CodingBox QSFP to SFP Adapter

QSFP to SFP Adapter